E-Scooters in Europe and Japan - Luup

2023-09-26

After the post〈NEW TRANSPORTATION IN SWEDEN- E-SCOOTER TIER, LIME, AND SO ON…〉, I’m still continuing my observation of E-scooter in Europe and Japan.

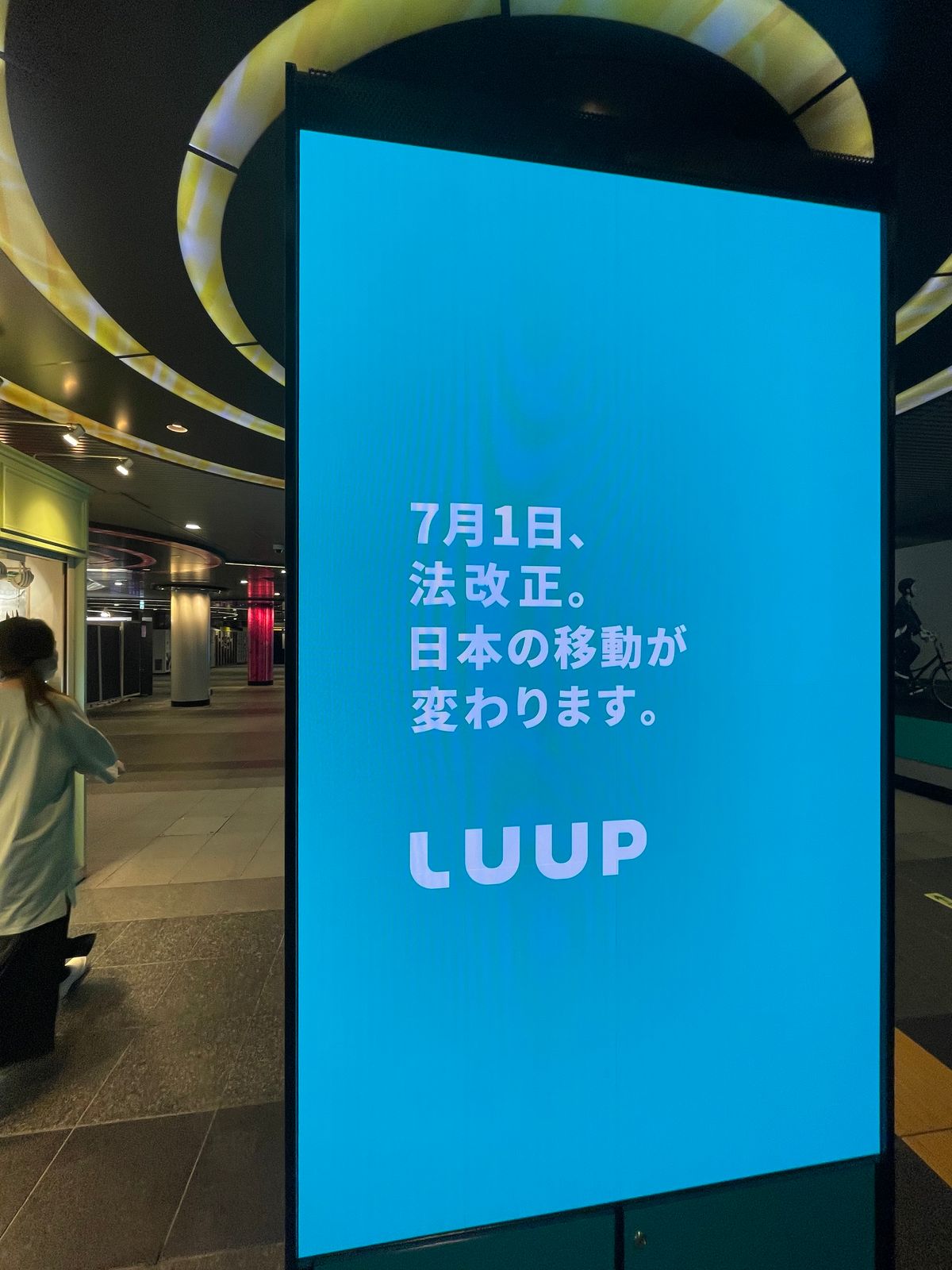

A few months ago, during my last trip to Tokyo, I came across a massive brand campaign for Luup right in the heart of the city. I was quite intrigued, considering Japan’s cultural tendency to avoid bothering others or making troubles to the society. I couldn’t help but wonder if electric scooters had a chance of quickly gaining traction and development in Tokyo. I’m eagerly looking forward to my next visit to Tokyo when I can try them out for myself.

The change in Japanese traffic regulations - E-scooter are now separate from motorcycles

It was this statement that caught my attention: “Regulations will change starting from July 1st. The way people move in Japan is on the verge of a transformation.”

It turns out that based on changes to Japan’s Road Safety Act, new regulations for electric bicycles and E-scooter will come into effect starting July 1, 2023. The most significant focus of these regulatory adjustments is the separation of small motorized vehicles, like E-scooter, and the introduction of specific traffic rules. Here are the key points:

- Riding E-scooter does not require a driver’s license, but riders must be at least 16 years old.

- It is strongly recommended to wear a helmet while riding.

- Approved vehicle types can use bicycle lanes.

- Under specific conditions, they can also be ridden on sidewalks (limited to speeds below 6 kilometers per hour) or road shoulders.

- Clear penalties are specified for dangerous behaviors that correspond to other traffic violations.

I found that Luup’s promotion approach particularly interesting because the brand logo in the ads is not as noticeable than the regulation. This approach seems to align with the Japanese culture of following rules, and it’s unlikely that law-abiding Japanese citizens would try such transportation without knowing the updated regulations which indicates that E-scooter is allowed in many public areas.

On a side note, in the Netherlands, there are instances where various groups or individuals disregard regulations, riding dangerously on narrow bike lanes, double-riding electric motorcycles, not wearing helmets, and even speeding at 40 kilometers per hour in construction-blocked areas. I often feel like telling them, “If you want to risk your life, please don’t involve me!”

From many aspects, directly mentioning the content of these regulatory changes in marketing materials is a unique market strategy. It also clearly highlights that Luup’s biggest hurdle in its previous Go-to market efforts was indeed the regulations.

Luup is now promoting in Tokyo. Instead of showing brand slogan, they highlights the update of Japan transportation law regarding the E-scooter

Luup’s parking space near Shibuya Miyashita Park

Luup - To start and the fee

Now, let’s delve into the cost aspect that many people are interested in. Currently, the pricing structure is a base fee of 50 yen plus 15 yen per minute. The fees for E-scooter and electric bicycles are currently the same.

It’s only after the regulatory changes that Luup could aggressively promote its services, and I believe this pricing is quite competitive. There aren’t any competitors in the market that are pushing their services as vigorously. With proper execution, Luup should have the potential for a significant surge in membership growth by the end of the year.

Luup Pricing

Luup’s usage system is also very convenient, resembling the colors and usage patterns of Tier scooters in Europe, almost like twins. Users need to locate nearby E-scooter via the mobile app and then scan the QR code on the scooter to activate it. The only difference is that Luup requires users to set their intended return location (which can be changed if needed during the ride).

Luup User guide

The trade-off of Luup’s activating process and parking

This approach to design thinking is likely based on the fact that shared electric scooters in Japan still adhere to a fixed location rental; in the other words, to only rent and return a moblie at the assigned spots. To avoid overcrowding at single return points, users are encouraged to plan their return locations in advance. What I find interesting is that in the initial rollout of electric scooters in Europe, there wasn’t much consideration for designated return points. It was only later, due to resident protests and government regulations, that restrictions on return areas were added.

Luup, starting from Japan, incorporated designated return points from the outset. This approach can potentially alleviate early expansion issues where users park at random places and affect the cityscape. In business management aspect, this added flow will potentially help Luup to reduce maintenance fee on collecting vehicles from anywhere in the cities. Looking at the successful example of Taiwan’s U-bike system, Luup’s approach appears feasible. However, the challenge here is how to quickly attract private businesses or public areas to provide designated spaces. Another trade-off here would be giving up the opportunities to expand service area rapidly.

It’s worth mentioning that this approach is gradually being introduced in Sweden as well.

Voi designed parking spots in the city center of Malmö, Sweden

E-scooter in Europe now

Market Saturation and New Regulations

Electric scooters are on the rise in Japan, but Europe has already gone through its experimentation phase and is entering an evaluation stage. Apart from safety concerns, Paris has even held a public referendum to ban shared electric scooters this April. In other European cities, market saturation has led to intense competition for E-scooter brands. As mentioned in a previous blog post, Stockholm alone had around five or six shared electric scooter brands operating within the city, which, while convenient for users, created challenges for the brands themselves.

Returning to Sweden, I discovered that Tier and Lime had quietly exited the scene in Malmö, leaving Voi as the sole player. It’s unclear whether Voi’s Swedish origins have any influence on this. Tier continues to operate in nearby cities like Lund and Helsingborg in the south, while Lime retains a presence only in Stockholm.

Speculated reasons for these brands exiting include high electricity costs and seasonal factors. However, after an entire summer, electric scooters have not made a comeback. Besides financial considerations, it’s likely related to government regulations and restrictions. Malmö’s municipal had initially placed limitations on where electric scooters could be used and had been gradually tightening regulations on parking locations. Stockholm has also begun discussions on relevant traffic regulations, potentially restricting scooter usage on sidewalks. However, the initial rise of electric scooters was to address short-distance urban commuting needs in Swedish city centers, where parking is expensive and scarce. If electric scooters are forced to adjust their operating areas, their appeal to consumers may diminish.

Product Value and Sustainability

Promotion of electric scooters in Europe often centers around “sustainability”, with Tier emphasizing climate neutrality and Lime highlighting “Ride Green.” However, when it comes to the fundamental aspect of product value, sustainability isn’t the primary reason consumers give electric scooters a chance. If you ask the majority of European electric scooter users, they use them primarily for short, urgent commute, convenience, and the willingness to try something new.

Even when considering the sustainability aspect, calling electric scooters zero-carbon is overly optimistic. They can only replace more polluting cars for short trips and can’t substitute for long-distance transportation. The most environmentally friendly and sustainable approach for short-distance travel is actually cycling or walking, both of which are common in Sweden and the Netherlands, where covering 2-3 kilometers by bike or foot is quite feasible. Additionally, we mustn’t forget the waste generated during electric scooter maintenance and the production of power sources. This might explain why, in the Netherlands, where cycling infrastructure is well-developed and cycling is prevalent, there aren’t as many electric scooter users. Similarly, in Sweden, where cycling commutes are relatively high, strict parking regulations and road access might lead to a significant decrease in electric scooter usage.

In this context, Voi’s marketing strategy appears clever. While they do provide information about sustainability on their website, their primary focus is on integrating with public transportation systems, which might be the primary product value that customers would like to see.

Is riding electric scooters dangerous?

When I wrote the previous post, I mainly referred to my experiences riding electric scooters in Malmo and Stockholm. Since then, I’ve observed more potentially dangerous situations in various European cities, uncovering some issues:

- No Turning Signals: Electric scooters lack turning signals, so if users don’t habitually use hand gestures for turning, vehicles behind them won’t know how to react.

- No Rearview Mirrors: They lack mirrors to track vehicles behind and beside them.

- Two-Person Riding: Riding with a passenger can lead to instability and distractions in case of emergencies, diverting attention away from road conditions.

- Not Yielding to Pedestrians: In Sweden, pedestrians have priority on the roads. When pedestrians approach a pedestrians crossings, vehicles must stop, regardless of whether pedestrians intend to cross. This rule also applies to cyclists, skateboarders, and electric scooter riders. However, electric scooter riders sometimes forget to yield to pedestrians.

- Misusing Road Space: Some electric scooter riders believe they have the ultimate right of way, whether it’s on regular roads, bike lanes, or sidewalks, leading to potentially hazardous situations. This attitude might be a significant factor behind the ban on electric scooters in Paris due to reckless behavior.

- Inexperience and Accidents: Riders who aren’t familiar with electric scooters’ characteristics might collide or fall. Electric scooters have power, so even though they require initial foot propulsion, the acceleration at the start can be sudden. Combined with their small wheels, uneven road surfaces can pose a greater risk. Starting from uneven terrain or forcefully transitioning from the road to a sidewalk can result in the scooter getting stuck or the rider falling.

- Misjudging Distances and Neglecting Parked Cars: Is quite common for E-scooter to misjudge distance to the cars. Especially people exiting from the cars may not notice E-scooter riders on the sidewalks or pedestrians paths.

Frankly speaking, most of these issues rely on the E-scooter riders themselves to be cautious and responsible. Consequently, many brands are focusing on user education. I personally believe that interactive education methods like the “Irent School” offered by Taiwan’s shared car service Irent, which includes interactive learning and coupon offering, could significantly help users understand the correct way to use E-scooters.

Conclusion

I’ve personally ridden electric scooters less frequently now, primarily due to windy weather conditions and concerns about road and return conditions in unfamiliar places. Walking has become more convenient for me. However, if well-planned, I believe I’ll continue to use E-scooters in the future. I still see great potential for electric scooters’ development and look forward to trying Luup in Japan!

Reference: “Dutch E-bike GreenMo”、“Electric Scooter Revolution Faces a Reckoning in Stockholm”

Other E-scooter blog post:

〈NEW TRANSPORTATION IN SWEDEN- E-SCOOTER TIER, LIME, AND SO ON…〉